Dollars to Quantum Donuts

A bubble on the verge of collapse.

Rewind back to 2013. It’s a quiet summer day. In the distance you hear a car blasting the recently released “Thrift Shop” by Macklemore. Kids are running around through the water stream of an open fire hydrant. The sun shines bright across the suburbs.

Back on Wall Street, a bubble was forming. No, strike that, it was raging on. Analysts couldn’t get enough of it, pricing 3D printing stocks as if they were to replace all forms of manufacturing. By January 2014, 3D Systems Corp soared to around $96, a market cap of $9.6 Billion. Then it all came crashing down.

All the way down to $8. From $96 - a 92% decline in two years.

A similar bubble formed in the cannabis sector from 2018-2020. Then, it too, crashed back down. ACB 0.00%↑ went from a peak of $1416.62 all the way to $5.09 today. That’s a 99.6% decline. Ouch. You lost all your money.

Today we see a similar bubble raging on. But why? The markets are solid. Company earnings were resilient through tariffs. Rates are on the decline.

It all centers around the elephant in the room - AI. Most AI companies are private. This means to invest in the frontier labs requires being an accredited investor at the minimum and often times, much more - celebrity status. Where does this leave your average joe? Retail? Chasing. Chasing the “next AI”, from semiconductor stocks to, you guessed it, quantum.

We’ve been On Bubble Watch for a while. Back in January, when Howard Marks published this article, quantum had already surged. IONQ 0.00%↑ soared 500% to around $50 per share. Since then, it experienced turbulence, finally reaching $71 a share today, September 25, 2025. That’s a market capitalization of nearly $23 billion. To put that in perspective, analysts estimate IONQ will have on average $375 million in revenue in 2027. The stock trades at a 76 times 2027 revenue. Even DDD 0.00%↑ during it’s peak in 2014 traded at roughly 14x revenue for 2016.

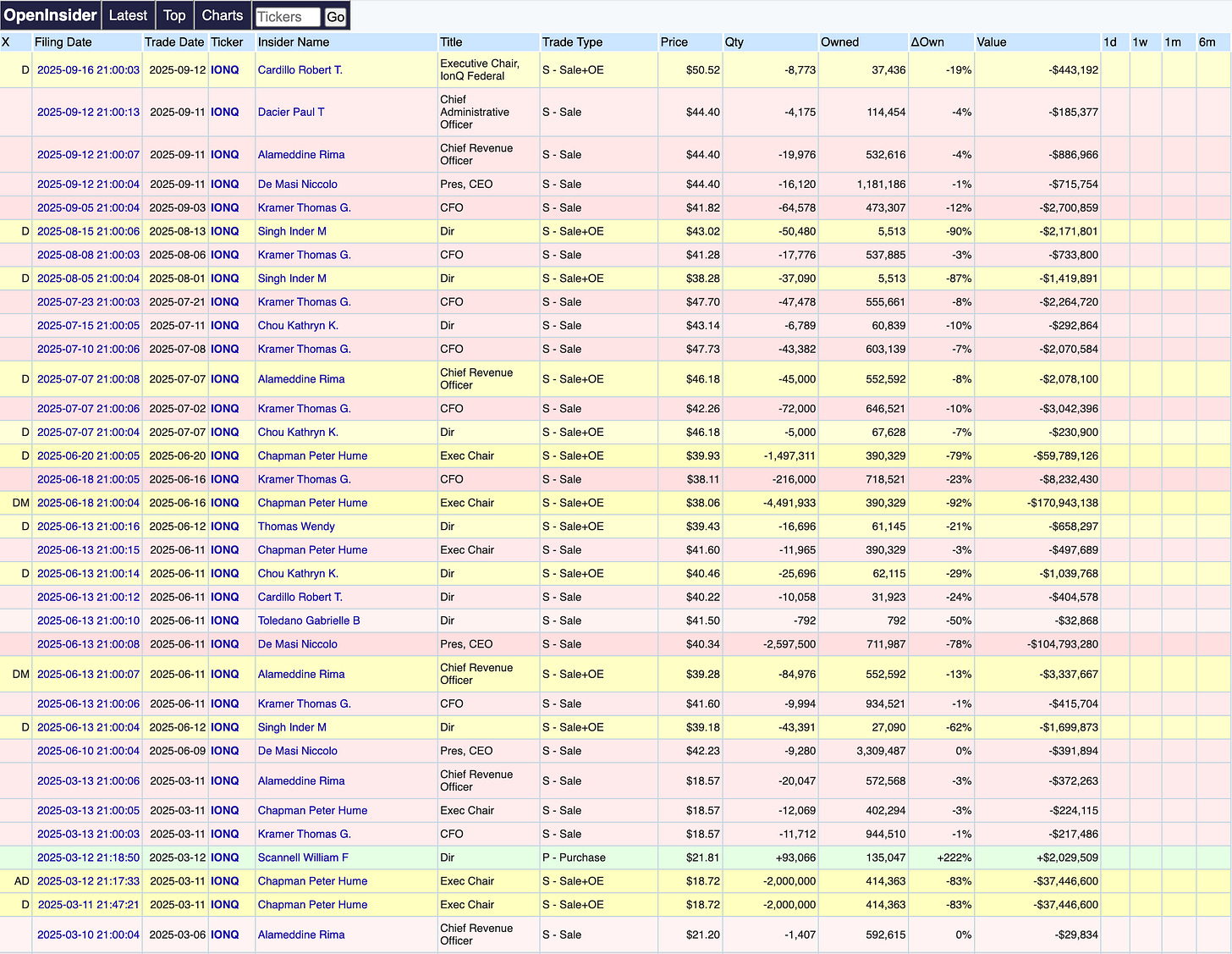

It gets better. IONQ insiders have been offloading as much as possible. The CEO sold $104 million worth of stock in June 2025. Yes, you read that right, $104 million. Shall we check on the exec chair? A cool $170 million sale followed by another $60 million worth of shares sold. Add in all the other sales, and you begin to feel the vibrations, if not the sonic boom of bad behavior.

After all, the original founder of IONQ, Christopher Monroe, walked away. This was the guy who knew the science. He could even earn a Turing prize. He left to return to academia and focus on real research. In an interview he states, “fortunately, we are, i think, probably, many decades away from quantum computers being able to attack that [bitcoin via Shor’s]” (source: x.com). So they have insiders dumping as fast as possible, founding scientists who left to focus on actual quantum research. What next?

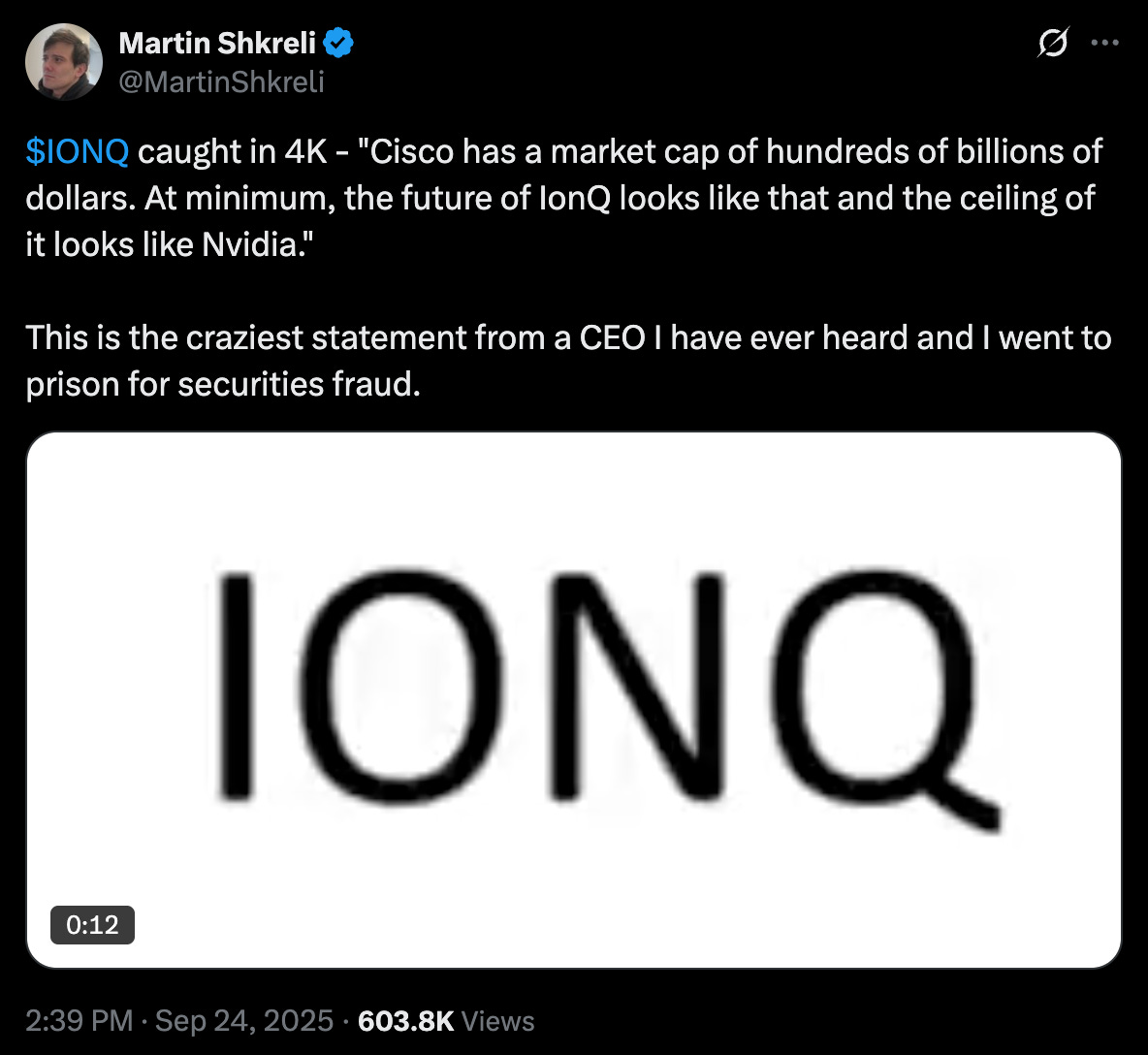

Oh. No comment needed.

But Martin didn’t stop there. Recently, Martin Shkreli had a debate with Shay Boloor on Quantum, specifically IONQ. Highly recommend watching this video. Even though it was three months ago and quantum stocks have extended their rally since then, it’s been circling around fintwit as of late This is the straw that breaks the camel’s back.

A separate interview between popular youtube streamer Amit Kukreja and Martin Shkreli discussed quantum for 25 minutes. Martin masterfully articulated the rationale counterpoints to the speculative bubble that is quantum.

First off, there’s a chance quantum as a whole doesn’t work, and that’s actually a pretty decent chance. Discount #1.

There’s a chance that even if it works, you’re not the company that wins. This is the case - there are many larger quantum players than IONQ. Discount #2.

And then there’s a chance that even if you win market share, the unit economics are really bad and commercialization fails. Discount #3.

Finally, on top of all that, if you discount the future cashflows, if the first three happen, what price could that offer today. Discount #4.

IONQ 0.00%↑ is priced like none of these discounts exist. Not one. Personally, I’ve never seen anything like it in my lifetime. At least with 3D printing, the technology has been used quite significantly. It’s fun. It’s cool. I can use it personally. Quantum? There’s a good chance I’ll never use it for a practical application. I’m not saying that’s a 100% chance, I want quantum technology to succeed in the long run. But it’s not worth $23 billion today. It’s not even worth $1 billion today.

This post isn’t meant to get into the technical details of Quantum Computing. But the good thing is we don’t have to. This is a situation where the numbers are so blazingly obvious that, to us, it’s a no brainer.

There are a number of wonderful technical and deep analyses out there that we are investing hours reading.

Kerrisdale Capital: IonQ, Inc. Trapped in the Hype.

Cantor Fitzgerald’s IonQ, Inc. Analyst Report.

Watch interviews, read papers, scuttlebutt. This is what due diligence is about. DYOR.

Best of Luck,

Refcell Capital

Disclosure: Not financial advice. Do your own research.

Let us know what you think in the comments, or message us in our chat.